330+ groups representing all 50 states and the District of Columbia called for Congress to support a resolution to overturn a rule that helps triple-digit interest rate loans spread across the country by evading state and voter-approved interest rate caps

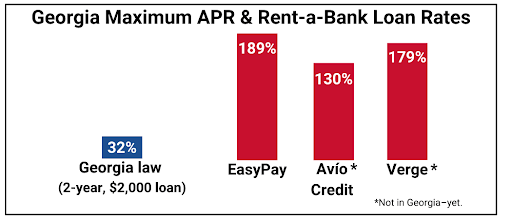

ATLANTA, Georgia – Georgia Watch applauds Senators Chris Van Hollen (D-MD), Sherrod Brown (D-OH), and Congressman Chuy García (IL-4) for plans to introduce Congressional Review Act resolutions to eliminate a Trump-era regulation that helps lenders charging 179% APR or more evade state- and voter-approved interest rate caps. The rushed “fake lender” rule took effect in December and was issued by the Office of the Comptroller of the Currency (OCC). The rule protects “rent-a-bank” schemes whereby predatory lenders (the true lender) launder their loans through a few rogue banks (the fake lender), which are exempt from state interest rate caps. The rule overrides 200 years’ worth of caselaw allowing courts to see through usury law evasions to the truth, and replaces it with a pro-evasion rule that looks only at the fine print on the loan agreement.

Earlier this week, Georgia Watch joined a broad coalition of more than 325 organizations representing all 50 states and the District of Columbia calling on Congress to overturn the “fake lender” rule, which threatens to “unleash predatory lending in all fifty states.” According to national polling, two-thirds of voters (66%) are concerned about the ability of high-cost lenders to arrange loans through banks at rates higher than the state laws allowed.

“Thanks to the strong enforcement actions of Georgia’s Office of the Attorney General, our state has successfully stamped out rent-a-bank schemes by exposing the non-bank predatory lender as the true lender,” said Liz Coyle, Executive Director of Georgia Watch. “We strongly support use of the Congressional Review Act to repeal the OCC’s True Lender rule, which threatens to limit our state’s ability to protect Georgians from lending that evades the usury cap.”

Predatory lenders charging 100% to 200% APR are already starting to push high-cost installment loans in Georgia that exceed the rates permitted under Georgia law, and others, including payday lenders, have pilot projects going with plans to expand to states that do not allow their high-cost loans.

Image Source: National Consumer Law Center.

As was done more than a dozen times under President Trump, this Congress could use the Congressional Review Act (CRA) to rescind recently finalized regulations, including the OCC’s “fake lender” rule, with just a majority vote in both chambers, limited debate, no filibuster, and the president’s signature. The CRA of the OCC “fake lender” rule will be introduced by Senator Van Hollen (D-MD), Senator Sherrod Brown (D-OH), and Congressman Chuy García (IL-4), and these resolutions also must be voted upon by a certain date, currently estimated between May 10 and May 21.